2. COMPARATOR DRUGS SOURCING PROCESS

2.3. Identification of the supply strategy to be used

2.3.1. Selection and communication of a comparator for a clinical trial

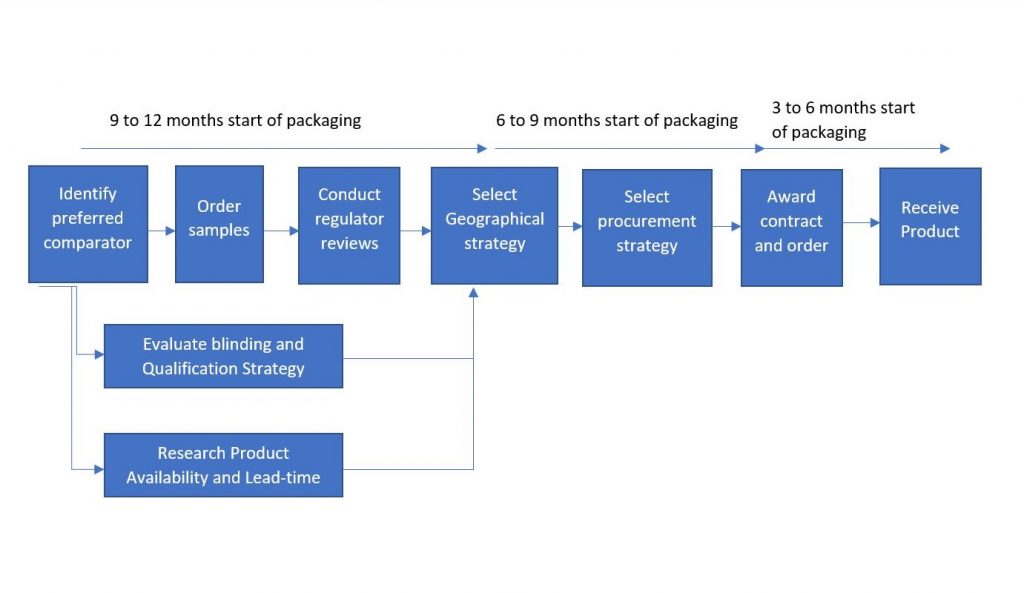

The comparator sourcing process should begin approximately 9-12 months before the comparator is received. This should allow for contingency and to identify the best strategic option for the complete duration of the trial.

Identifying the preferred Comparator

Typically, identifying the preferred comparator is the responsibility of clinical researchers and medical affairs specialists, but marketing departments also can be involved. Individuals from these departments should work together to identify the target comparator. The comparator sourcing department should collate and feedback data to enable an informed decision to be made on the best comparator.

The factor involved in making a decision about the comparator are not limited to, but include the following important considerations:

- The consistency of comparator across market in which the IMP will be compared

- The availability and access to the product

- The supply risks

- The cost

- Ease of blinding

- Compliance with regulatory requirements

In a controlled experiment, variables should be kept the same, except for the one variable that is being tested. The consistency of the comparator should be considered, particularly when making any claims against the comparator, which is frequently the objective of such trials. For example, if there is a range of strengths of comparator available in various markets, the purchasing organization may select the strength of comparator that occur most frequently, or it may choose to drop a problem country from the study, depending on the study’s objectives and the importance of that market.

Large, single lots of product can help to maintain consistency and to create effeciences. Sourcing multiple lots from one or multiple suppliers to accrue sufficient material should be avoided.

A purchasing organization can construct a representation of what is available in each territory by identifying the different strengths, formulations, presentations, and brands that are available. An early indication can be established of how easily available each option may be, allowing the formulation of a strategy.

Availability (lead time, licensing and expiry dating) and access should be considered. Availability and access both contribute to the risks involved in sourcing comparators

Once several potential candidates have been identified samples should be ordered so that they can be examined. The potential for any modifications, e.g., over-encapsulation or repackaging, that may be required can be assessed. For further information on modification and stability considerations. The final consideration is the potential costs of a sourcing strategy and to balance these with the risks identified and options available.

Choosing Branded or Generic Comparators

The choice of whether to use a branded or generic product may be a cost consideration. It also can be determined based on factors such as:

- Presence and status of the best in class drugs on the market

- Unmet needs and market segmentation

- Pricing of the comparator on the market

- Perceived, distinct advantages of the investigational drug in terms of efficacy and/or safety profile

The selection of a generic product as a comparator may be excluded before the cost advantage can be taken into a consideration. Use of branded product could be necessary to meet the commercial objectives of a study.

| Option | Branded (Innovator) | Generic |

| Pros | Usually best for making marketing claims | Cheaper than branded |

| May be the only option as standard of care | Can be easier to access documentation | |

| Proven with clinical/non-clinical data available | Generic manufacturers may be willing to provide active products plus placebos | |

| Cons | More expensive | Must be certain of a bona fide source (although this applies to branded product as well) |

| May be more commercially sensitive, i.e., accessing large volumes could draw attention to trial activity | Quality of product may not be recognized in all territories (quality also may be an issue with branded products) | |

| Can be more difficult to access large volumes in all study territories | Strength, presentation, or formulation less likely to be available in all study territories |

Ordering Samples

Once the comparator has been selected, the purchasing organization can order a sample of a product for internal review. The samples can provide an opportunity to study the label and patient information leaflet and to conduct stability testing.

Labels for product approved in Europe can be found in the EMA websites.

The samples also enable the assessment the comparator’s packing and a blinding and qualification strategy can start to be developed.

Counterfeit Avoidance

Counterfeit medication represents a risk to patient safety by:

- Not containing the right amount or quality of active product

- Not containning any active product

- Possibly containing an agent that could be directly harmful to a patient.

When sourcing a comparator, the traceability of the product should be known. The purchasing organization or their direct supplier should be able to trace medication back to manufacturer and minimize the risk of any counterfeit medication entering the supply chain.

Security in the supple chain could be achieved by obtaining comparator directly from a manufacturer, but this is rarely possible due to lack of supply infrastructure and concerns about confidentially. The objective should be to keep the supply chain as short as possible, preferably there should be only one link in the chain (i.e. one supplier) between the purchasing organization and the organization manufacturing the comparator. Where possible, audited suppilers should be used that:

- Can provide documentation to establisd the quality of the medication being supplied

- Have a rebust process in place for documenting the traceability of a comparator.

Source: ISPE Good Practice Guide

You must be logged in to post a comment.